I know, I know–reviewing Flash Boys is so last week. But I approach my reading the way I approach my running: Don’t worry about what everyone else is doing, just get there in your own time. (Incidentally, this is also how I approach fashion, new music, travel, food fads, and pool.)

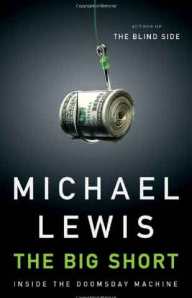

If you’ve managed to miss out on the Flash Boys Extravaganza (which sounds like a raunchy Chippendales show), it goes like this: Michael Lewis, best known for writing the seminal Wall Street memoir Liar’s Poker, as well as The Blind Side and Moneyball, published a book about high-frequency trading in which he said, essentially, that the stock market is rigged against the average investor. Flash Boys, which primarily investigates high-frequency trading through the eyes of Royal Bank of Canada whiz kid Brad Katsuyama, unpacks the wonky details of HFT to a damning conclusion: Firms are exploiting technological and regulatory limitations in the system to receive, and act on, advance knowledge of trades. More broadly, Flash Boys explains how over the last decade, the stock market has gotten more complex (in addition to the NYSE and Nasdaq, there a dozen other exchanges now) and less transparent (an increasing number of trading is done in “dark pools” whose makeup and workings aren’t public). As is his style, Lewis tells a great story, and what emerges is both a condemnation of HFT firms, banks and regulators for ignoring or taking advantage of the unfair market, and a bit of a love letter to Katsuyama, who Lewis paints as the humble hero, the guy who chooses to expose injustice rather than profit from it.

Continue reading “Flash Boys is lucky it doesn’t have weirder Google Image results”